By Anne Louise Cropp ’99 MBA/MHA

When David Marcinek attended Penn State in the early 1990s, he knew that he wanted to work on Wall Street. He just wasn’t sure how to get there.

“The way I tried to get a job was old school: you’d get the names and addresses of recruiters at different investment banks, write long cover letters, attach your resume, and then beg and plead for an interview,” he says.

Despite his best efforts as an undergraduate, the former Goldman Sachs partner and current chairman and senior managing director of Venerable Holdings did not find his way to Wall Street until after he earned an MBA from Columbia University in 1998.

Things had not changed much for Penn State students by the time Ali Chaudhry enrolled in the late 1990s. But a handful of other universities across the country had begun to incorporate real-world experience into the learning environment by establishing collegiate trading rooms and student-managed investment funds.

Chaudhry, along with classmates Nathan Kline and Sachin Aggarwal, wanted Penn State to be a part of that trend.

They founded the Penn State Investment Association (PSIA), a precursor to Smeal’s highly successful Nittany Lion Fund, in 1999 to help students pursue careers on Wall Street. When it was first formed, PSIA taught about the function of capital markets, including research and analysis, and also offered a hands-on approach to portfolio management through a paper investment portfolio.

Their ultimate vision was to create a student-managed investment fund using real investor dollars. “We knew we’d need to build a track record first, which takes years. PSIA gave us a way to do that,” Chaudhry says.

The trio moved closer to their vision in 2001 when a gift from Dave Rogers, chief executive officer of J.D. Capital Management, and his wife, Tricia, established the Rogers Family Trading Room.

“The trading room raised the profile of investment finance at Penn State overnight, giving us access to the same financial information Wall Street firms were using. It also boosted student morale to know that our alumni saw value in what we were trying to do,” Chaudhry says.

By 2002, PSIA leadership was ready to take the next step, delivering a 200-page investment prospectus to J. Randall Woolridge, professor of finance and the Goldman Sachs & Co. and Frank P. Smeal University Fellow.

Woolridge shared the prospectus with prominent Smeal alumni, including Dave Rogers, Frank Smeal, Bill Schreyer, Ed Hintz, and Art Miltenberger.

“Each offered their expertise and leadership, and we built up from that,” Woolridge says.

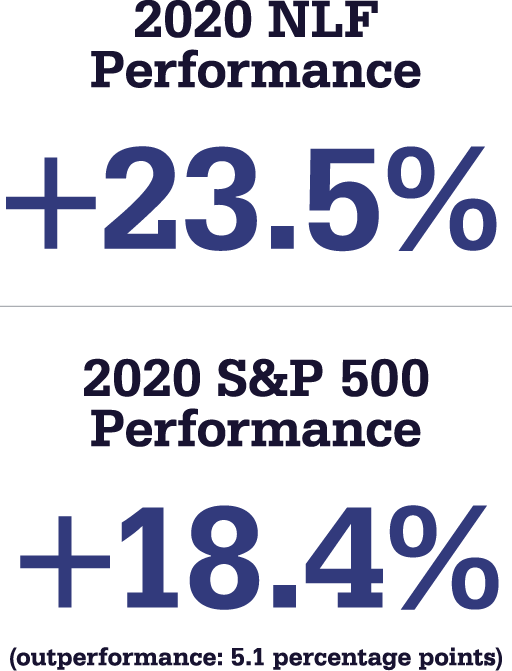

By January 2005, the Nittany Lion Fund, with 42 mostly alumni investors and more than $2 million in assets under management, placed its first trade. The fund celebrated its 15th anniversary in 2020. Today, it remains one of the few student-managed investment funds in the nation using investor money rather than endowment dollars. At the close of 2020, the fund had 77 investors and more than $12 million in assets.

Thinking back to the early days of PSIA and the Nittany Lion Fund, Aggarwal says everyone understood how important it was for students to be able to draw from their own experience during an interview rather than rely on the textbook definitions of important concepts.

“After a few years, if you said you were from Penn State, people really started to pay attention,” Aggarwal says.

Marcinek agreed. He says that when he started at Goldman Sachs, Penn State students weren’t on the company’s recruiting radar. By 2010, Smeal was one of Goldman Sachs’ target schools.

Woolridge, the fund’s faculty advisor since its inception, says that long hours, competition among students, and high expectations for performance prepare learners for the realities of a career on Wall Street.

“The tenacity you build when you fight for everything matters. That work ethic is crucial on Wall Street and it has translated into student success,” he says.

Before the trading room and the Nittany Lion Fund, Woolridge says one or two students a year might receive an offer to join a Wall Street firm. In 2007, just three years after the launch of the fund, every one of the fund’s 17 graduating seniors accepted a full-time position on Wall Street.

Allison Pavlick was a part of that group.

She credits the Nittany Lion Fund and its alumni network for her career success.

“Everything I learned in the fund was directly applicable to an investment banking career. I wouldn’t have the resume I have today if it weren’t for the people I met or the experiences I had through the Nittany Lion Fund,” she says.

Chaudhry says that he’s proud of how far PSIA and the Nittany Lion Fund have come in the last two decades.

“It’s been incredibly rewarding to see how a simple idea, a shared vision, and lots of teamwork turned into an organization that stood the test of time and continues to place Penn Staters all across Wall Street,” he says.

Although the Nittany Lion Fund is considered the marquee program for the Finance Department, it’s just one of many initiatives designed to enhance finance education at Penn State.

In 2017, Dean Charles H. Whiteman convened Smeal’s Finance Advisory Board, led by Marcinek and co-chair Craig Chobor, managing director and director of research at Solus Alternative Asset Management, to help ensure the college is meeting the complex needs of future generations of Finance students.

Leveraged Lion Capital, the nation’s first student-run syndicated loan and high-yield bond paper portfolio, is just one example of innovative new programming encouraged by the board. Through Leveraged Lion Capital, Smeal students research, analyze, and pitch speculative-grade debt for a $125 million paper bond portfolio.

Initiatives like Leveraged Lion Capital and Wall Street Boot Camp have only added to the success of Smeal’s students. When combined with the placement success of the Nittany Lion Fund, nearly 100 students accept internships and full-time positions at well-known firms such as Citigroup, Bank of America Merrill Lynch, Morgan Stanley, UBS, Credit Suisse, J.P. Morgan, and Goldman Sachs each year.

Although the Rogers Family Trading Room may have been the impetus behind the path to Wall Street for Smeal students, Marcinek says that it doesn’t always take a lot of money to make a big impact. “Sharing your time can make a big difference for students, too,” he says.

Nittany Lion Fund alumni take that advice to heart.

“The give-back mentality is huge,” Woolridge says. “Our alumni know how tough it is to get to Wall Street, and they see it as their job to help other Smeal students get there, too. They are among our most generous alumni; they speak in our classes and they recruit our students. It’s been amazing.”

Philanthropic Vision Brings the Wall Street Experience to University Park

Dr. J. Randall Woolridge calls Dave and Tricia Rogers “visionary.”

“They understood that if Penn State had a trading room on campus, it would open doors for students who were interested in a career on Wall Street. They were willing to do whatever it took to make that happen,” says Woolridge, professor of finance and the Goldman Sachs & Co. and Frank P. Smeal University Fellow.

Funded with a $1.1 million gift, the Rogers Family Trading Room features dual-monitor workstations, video conferencing capabilities, and access to the same financial software used on Wall Street. In 2011, the couple sponsored the Rogers Family Trading Room Challenge, matching $1 million in donations to the endowment that supports the trading room’s day-to-day operation.

“Dave and Tricia’s generosity truly transformed our college,” says Dean Charles H. Whiteman. “Without the Rogers Family Trading Room, there wouldn’t be a Nittany Lion Fund. The physical space and the resources the trading room offers, along with the fund’s real-world trading experience, have made Smeal one of the most respected sources of new investment banking talent,” he says. “We couldn’t have done it without their vision and philanthropic leadership.”

Where are they now?

Ali Chaudhry is currently chief executive officer of MyOfficeBot, a firm offering software robots that improve business efficiency by automating repetitive processes. Nathan Kline is chief investment officer at One Wall Partners. Sachin Aggarwal is a managing director at Evercore Partners. And Allison Pavlick is now a principal at venture capital firm 8VC.

Photos by Stephen Moyer