Researchers probe the impact of irrational decision making in the supply chain

It’s spring 2020, and the COVID-19 pandemic has arrived. Nervous consumers rush to stock up on hand sanitizer, buying much more than they need — “just in case.” In response to the spike in consumer demand, retailers increase their orders to manufacturers, who scramble to keep up, ramping up production.

Fast forward to today: Hand sanitizer is abundant, easy to find, and often deeply discounted.

This is a classic example of the bullwhip effect: when a small change in consumer demand leads to much greater changes in demand for raw materials at the factory level. Brent Moritz, associate professor of supply chain management in the Penn State Smeal College of Business, along with co-authors Arunachalam Narayanan, associate professor of analytics at the University of North Texas, and Chris Parker, associate professor of information technology and analytics at American University and a former member of the Smeal faculty, recently published a paper that explores the bullwhip effect in the journal Manufacturing & Service Operations Management.

Moritz and his colleagues specifically examined how irrational ordering can disrupt the supply chain and set off the bullwhip effect. Using a variation of the well-known simulation called the Beer Game, invented at MIT’s Sloan School of Management, they observed what happened when humans acted as inventory managers in a simplified, four-level supply chain: retailer-wholesaler-distributor-factory.

“The Beer Game allows us to observe, in a controlled setting, how supply chains work together when you have multiple people making independent decisions,” Moritz says. “Supply chains can be more or less complicated than that four-level model, but the Beer Game has enough complexity to show relationships between levels in the supply chain without being too difficult to understand.”

The researchers wanted to measure the impact of behavioral ordering — sometimes called irrational ordering — on the supply chain and differentiate that from rational ordering.

Rational ordering, Moritz explains, is behavior, absent of emotion, that’s based on the structure of supply chains and how they work. “So, if you have a small increase in ordering at the retail level, for example, some of that increase will get passed to the wholesale level, and that wholesaler should logically increase orders based on that signal,” he says. “That’s the rational, logical thing to do.”

Brent Moritz, associate professor of supply chain management, and a team of researchers examined how irrational ordering can disrupt the supply chain and set off the bullwhip effect.

“The Beer Game allows us to observe, in a controlled setting, how supply chains work together when you have multiple people making independent decisions.”

On the other hand, irrational ordering can happen when the person placing the order gets nervous and overreacts to an increase in demand — ordering much more than needed (“just in case”) or forgetting about inventory they’ve already ordered but haven’t yet received.

They found that, while irrational behavior by a distributor or factory mostly impacts those same levels of the supply chain, irrational behavior by a retailer creates a ripple effect that travels to other levels of the supply chain.

“Our results show that inserting a human decision maker into a supply chain is more costly than expected, that this cost increase is greatest when humans are at retailer level, and that those retailer-level decisions affect the entire supply chain,” Moritz says. “Moreover, we found that having multiple individuals making ordering decisions increases the bullwhip effect.”

He points out that, contrary to some previous research that explains the bullwhip effect as a natural consequence of the structure of the supply chain, “we show that it’s not just the structure, it’s not just rational, there is human behavior that makes the bullwhip effect worse.”

In their analysis of the behavioral implications of effective supply chain leadership, Moritz and his colleagues argue that information sharing across the supply chain could help mitigate the bullwhip effect. “In our Beer Game setting, one intervention is to allow everyone to share information about consumer demand across the supply chain,” he explains. “Unfortunately, in the real world, that’s not always possible.”

He cites the relationship between Procter & Gamble and Walmart as an example of established information sharing between two large companies. “P&G has very good information sharing with a company like Walmart. So, when someone buys a box of Tide at Walmart, P&G sees not only the inventory levels of Tide on the shelves, they know that somebody just bought a box. They can see what the consumer demand is, so they are far less likely to overreact to demand. But if you’re a small retailer, say a mom-and-pop convenience store that happens to carry a little bit of Tide, you don’t have that same level of information sharing.”

The researchers also included a brief cognitive reflection test in their Beer Game simulation and found that individuals who scored high on cognitive reflection tended to exhibit less irrational behavior, and supply chains with more of those individuals had better performance. “This suggests that managers should carefully consider training and evaluating their employees before assigning them to key supply chain roles that require high cognitive reflection,” Moritz says. “Having decision makers with high cognitive reflection can partially mitigate costs and improve results for both the firm and the supply chain.”

This research was funded by the Penn State Smeal College of Business, the G. Brint Ryan College of Business at the University of North Texas, and American University.

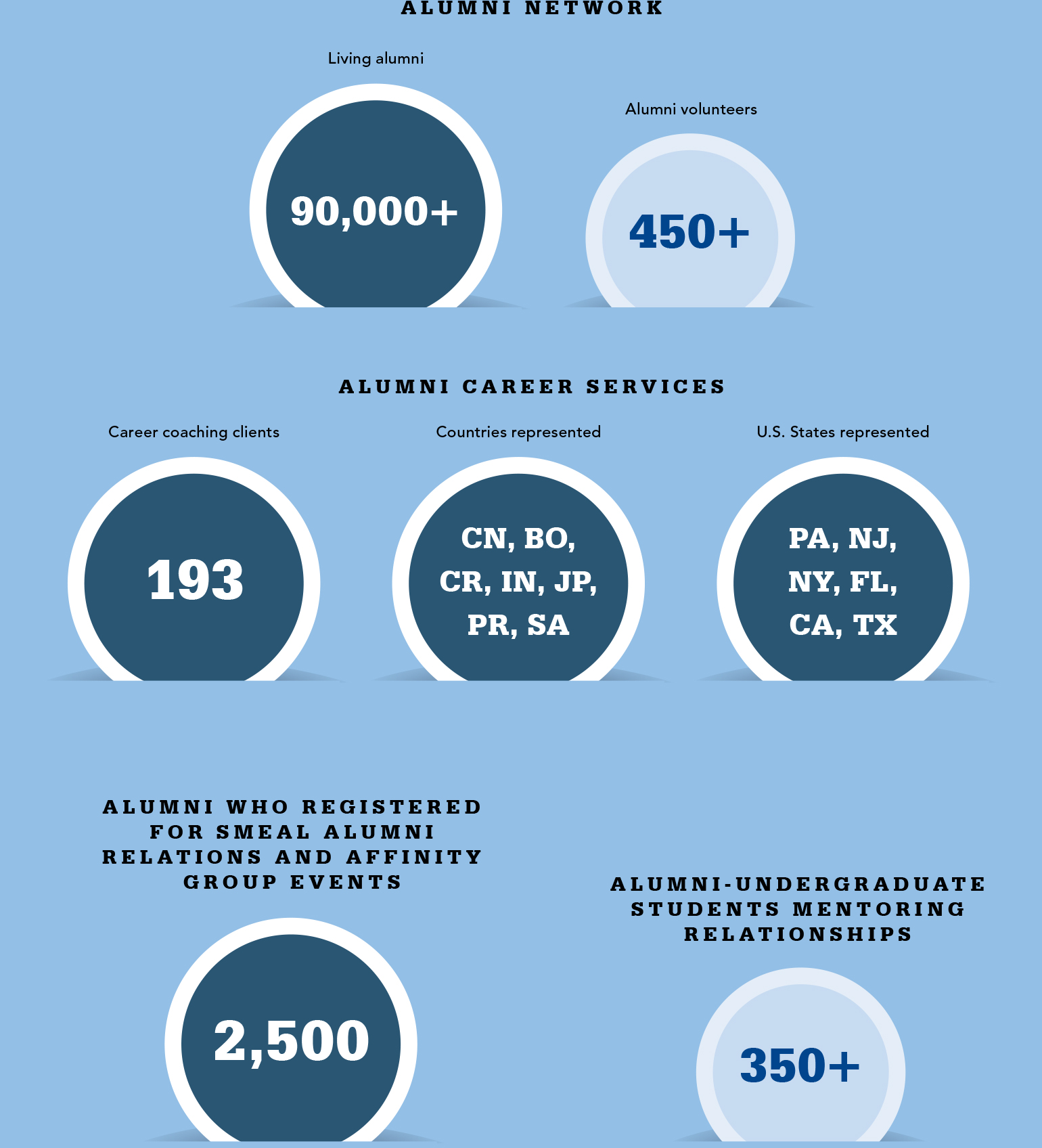

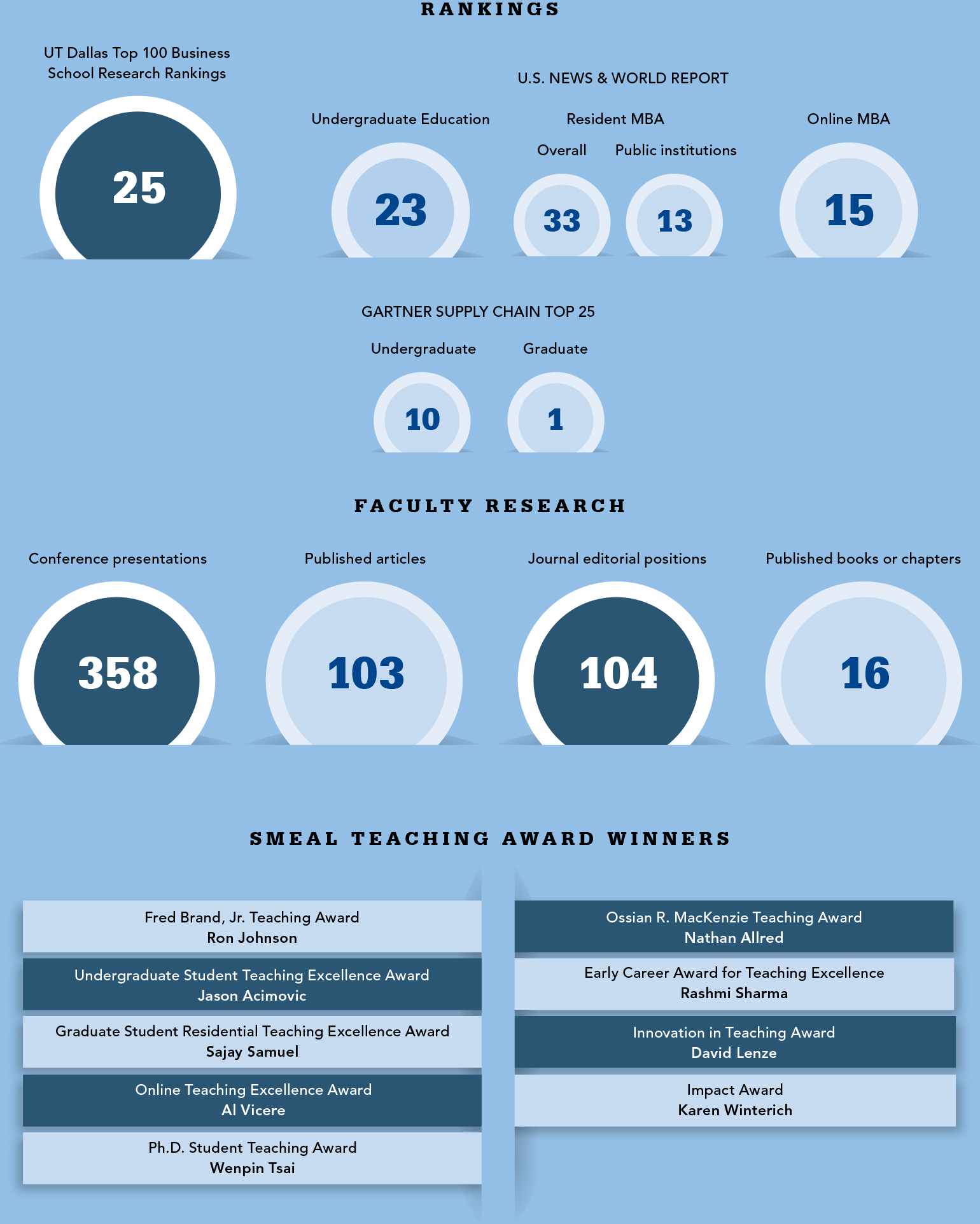

Smeal By the Numbers

Smeal’s Driven Community